We are an Equal Employment/Affirmative Action employer. We do not discriminate in hiring on the basis of sex, gender identity, sexual orientation, race, color, religious creed, national origin, physical or mental disability, protected Veteran status, or any other characteristic protected by federal, state, or local law.

Why Interest Rates Don’t Really Matter: A Fresh Perspective on Home Financing

When it comes to home financing, most homebuyers and investors are laser-focused on securing the lowest possible interest rate. After all, it seems like the most logical strategy—it is the single biggest factor to minimize the cost of borrowing!

But here’s the thing: interest rates aren’t the end-all/be-all when it comes to buying a home. In fact, in my 29 years of experience as a mortgage originator, I’ve discovered that two powerful factors—appreciation and leverage—often have a much greater impact on your financial success than the interest rate itself. And when it comes down to getting your dream house, or the house that is in the right location, your peace of mind and having a space to call your own is worth a few extra dollars. Let’s dive deeper into why interest rates might not matter as much as you think.

The Power of Appreciation

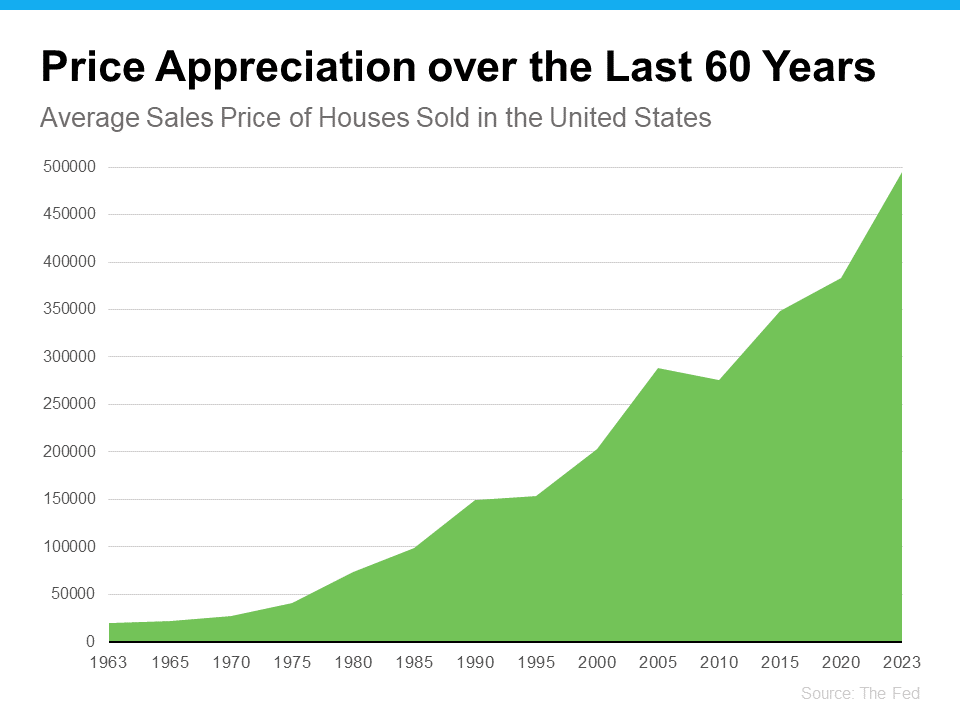

In real estate, the term appreciation refers to the increase in the value of a property over time. This is one of the most significant long-term advantages of buying a home. Historically, homes in the United States have appreciated at a national average rate of 3-5% per year, a trend that has remained largely consistent since the 1960s. And if you live in areas of faster rates of appreciation, it just doesn’t make sense to keep sitting on the sideline, waiting for interest rates to drop, while you let tens or hundreds of thousands of dollars pass you by.

Why Appreciation is Key

The beauty of appreciation is that it doesn’t rely on you doing anything other than owning the property. Your home’s value grows over time, making it an excellent investment that keeps up with or in some areas far outperforms inflation and other traditional investments. In markets where demand continues to rise, you will see the benefits more quickly.

Here’s a quick example of how appreciation works:

Home Price: $400,000

Down Payment: 5% ($20,000)

Annual Appreciation Rate: 4% (the midpoint of the 3-5% national average)

Year 1 Home Value: $416,000

Year 2 Home Value: $432,640

Year 3 Home Value: $449,000

Year 4 Home Value: $467,000

Year 5 Home Value: $486,000

In just five years, your home could increase in value by $70,000, or a 350% return on your original $20,000 investment. This makes it clear that the growth in your home’s value can far outstrip the additional costs associated with a higher interest rate.

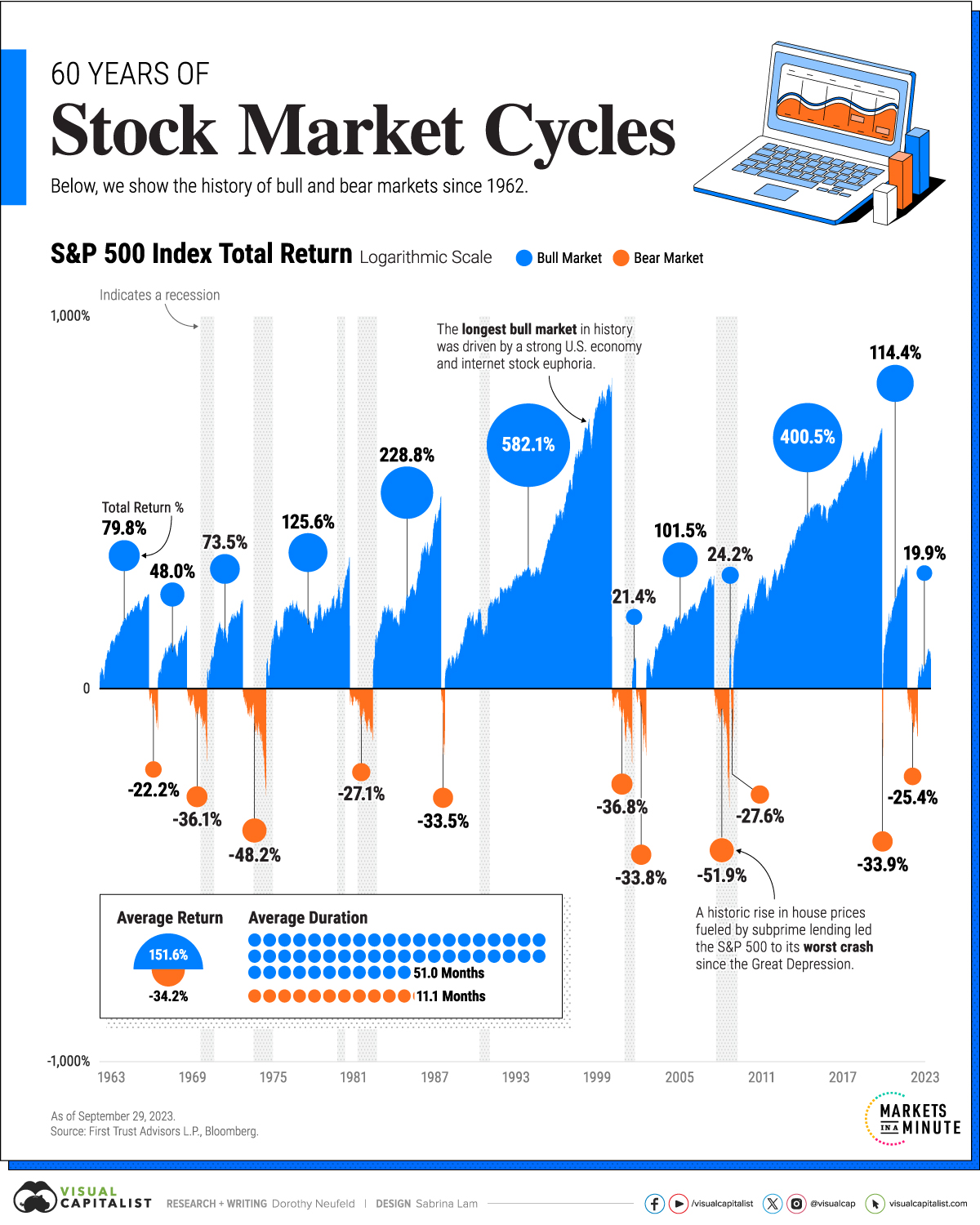

Appreciation: Real Estate vs. Stock Market

Wondering how real estate fairs against the stock market? While stock market investments can yield substantial returns, real estate remains a reliable option, especially when you factor in other considerations like tax benefits and rental income potential. If you know how to always pick a winning stock, then you can realize great gains. But in truth, choosing winning stocks is not an easy task and it is time consuming to keep up to date on stock and business trends. This graph shows the stock market has periods of growth, but also regular periods of loss. If you want a place to put your money and have it appreciated without doing research every month, week or day, real estate is a great investment. See the consistent appreciation over the last 60 year period.

National Average Home Price Appreciation (1960s-Present)

The Power of Leverage

In addition to appreciation, leverage is another powerful reason why interest rates may not be as important as you think. When you take out a mortgage to buy a home, you’re using leverage—borrowing money to increase the potential return on your investment. This allows you to use other people’s money (the bank’s) to finance an asset that will grow in value over time.

Why Leverage Matters

Leverage becomes even more powerful when you realize that mortgage rates are typically lower than the returns you could earn in other investments, such as the stock market. For example, if you invest your extra cash in the S&P 500, the long-term average return is significantly higher than most mortgage rates.

Here’s some historical data to consider:

- 10-Year Average Return (S&P 500): 14.8%

- 30-Year Average Return (S&P 500): 9.9%

- 50-Year Average Return (S&P 500): 9.4%

While mortgage rates can vary, they often fall below the historical returns from stock market investments. This means that by securing a mortgage—even at a higher rate—you may still come out ahead by leveraging that extra cash into higher-return investments.

What Can You Do With the Extra Cash?

Once you secure your mortgage, you don’t have to simply focus on paying off your loan early. Use the leverage that frees up your cash and, you can consider other financial options for your extra cash flow. Now, I’m not a financial advisory, accountant or attorney, but these are ways I’ve seen people increase their retirement and savings:

- Maximize Your 401(k) – Contribute as much as possible to take advantage of your company’s matching contributions.

- Invest in a 529 College Savings Plan – Set money aside for your children’s education and watch your savings grow tax-free.

- Buy Additional Investment Properties – Rental properties can generate passive income and appreciate over time, further diversifying your income streams.

- Invest in Life Insurance – Protect your family while potentially growing your wealth with life insurance options like whole life policies.

- Diversify Your Portfolio – Use extra cash to diversify your financial portfolio by investing in stocks, bonds, or other vehicles.

By leveraging your mortgage, you’re not only gaining a home but also positioning yourself for greater wealth in the long term.

Back to Basics: What Really Matters in Home Financing

So, what’s the takeaway from all this? While securing a low interest rate is nice, it’s not the deciding factor for financial success. The two most important factors that will help you build wealth through homeownership are appreciation and leverage. Let’s recap:

- Appreciation: Real estate historically increases in value over time, and this growth can outweigh the costs of a higher interest rate.

- Leverage: Mortgages often have lower rates than other types of investments, allowing you to put your money in higher-return assets, like the stock market, rental properties, or retirement funds.

- Buying Your Primary Residence: One last consideration to keep at the front of your mind is are you willing to walk away from the home you’ve been waiting for, just because the interest rate is 1% higher than you want? You can always refinance when rates drop, but getting the house you want in the location you want it might not come along again.

Take Action: Make Your Money Work for You

Understanding these principles can help you make more informed decisions when buying a home or securing a mortgage. It’s not always about locking in the lowest rate but rather about understanding the long-term benefits of homeownership and how to leverage it for financial growth.

If you’re considering buying a home or refinancing your current mortgage, you can explore more resources to learn about smart home financing options. Check out these additional articles and guides on mortgage tips, investing in real estate, and more.

Final Thoughts: Empower Your Home Financing Decisions

It’s important to look beyond just the interest rate when deciding to purchase a home. While we all want to minimize our monthly mortgage payment, you should also consider the long-term growth that comes from appreciation and leverage. These two factors can often deliver far more value than securing a slightly lower interest rate.

So, the next time you’re looking at mortgage options, take a step back and think about the bigger picture. Focus on building wealth over time through strategic homeownership, and use your mortgage as a tool to further diversify your investments. And if this is a home for your family, ask yourself if the interest rate is more important than building a home for your family.

To get started on your journey, feel free to explore more mortgage resources and investment strategies. Let's make your financial future even brighter, one home at a time.

Disclaimer: The information provided in this blog post is for educational purposes only and should not be considered financial advice. Always consult with a financial advisor or mortgage expert before making major financial decisions.