Every week we release educational videos related to hot topics in the mortgage industry on YouTube.

Subscribe to our channel to stay in-the-know!

If you’re planning to buy a home, one of the most important questions on your mind is probably: What credit score do I need to qualify for a mortgage? I’m here to save you hours of research and give you the real facts that matter most. We’ll cover the minimum credit score requirements for various loan types, from conventional to FHA, VA, USDA, and portfolio loans. Plus, read to the end for a bonus tip on how to boost your credit score by 40 to 50 points—fast!

Not all credit scores are created equal. While you may see one score when checking your credit card or car loan, the FICO score used for mortgages could be different. There are over three dozen FICO models, but 90% of lenders rely on one specific version for mortgages.

💡 Pro Tip: The best way to know your mortgage FICO score is to check with a licensed mortgage lender.

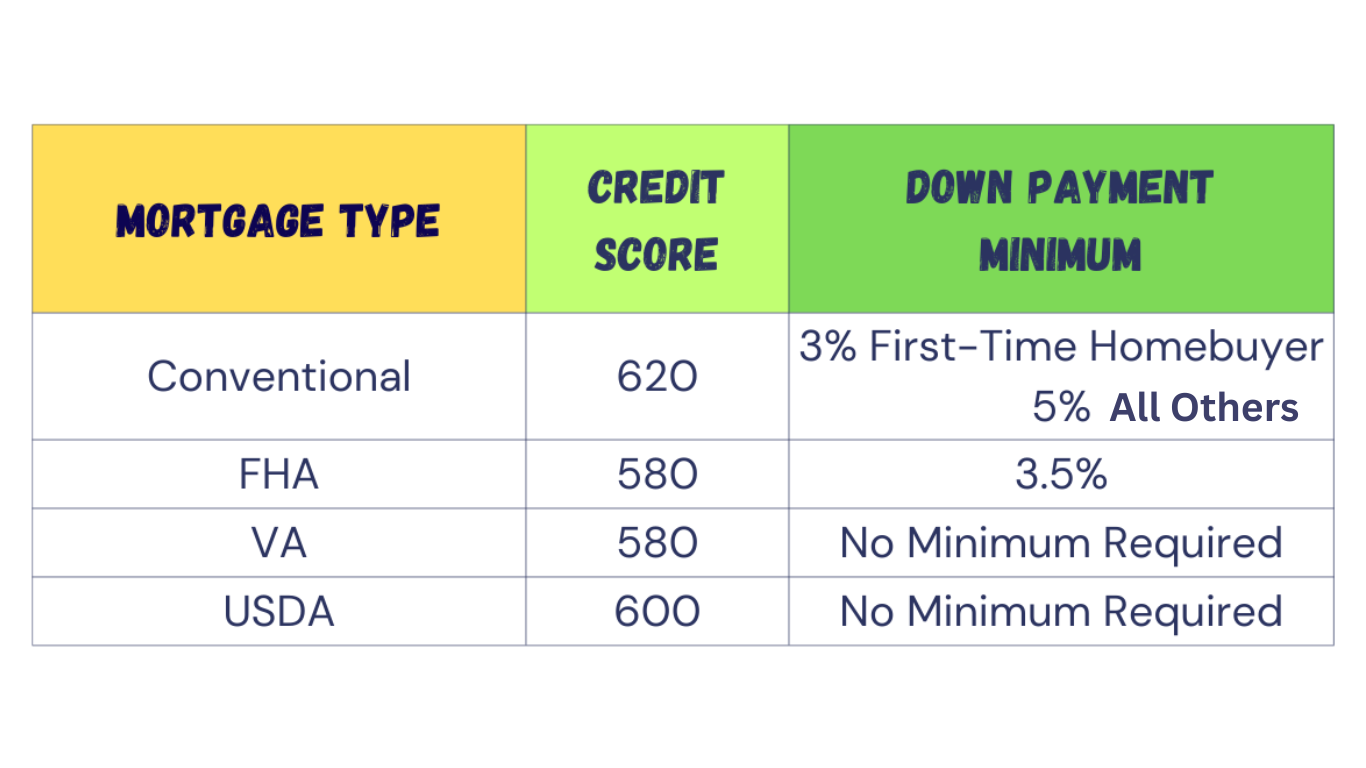

Here’s a breakdown of minimum credit scores for different loan programs:

Conventional loans are stricter on credit scores however offer the best terms and interest rates to borrowers with higher scores. If your credit score is below 680, you may face higher rates and stricter requirements.

👉 Learn more: Watch my video on Conventional Loans to see if this is the right loan for you.

FHA loans are a popular option for first-time homebuyers because they allow lower credit scores. However, if your score is below 600, be prepared for additional requirements like having reserves and low payment shock.

👉 Check out my full guide: What You Need to Know About FHA Loans for 2025

USDA loans are limited to rural areas and have strict debt-to-income ratio requirements. This program works well for those who qualify. Only about 4% of the mortgages are USDA due to its restrictions.

👉 Explore USDA eligibility: USDA Property Eligibility Map

VA loans offer some of the most flexible credit requirements and are available to eligible veterans and their spouses. Keep in mind that VA loans don’t allow co-borrowers other than a spouse.

👉 Watch: VA Loans Explained

Portfolio and Non-QM (Non-Qualified Mortgage) loans are more flexible and designed for unique situations—like using bank statements or profit-and-loss statements to qualify. However, they come with higher interest rates, especially for lower credit scores.

Want to boost your credit score by 40 to 50 points in just a couple of months? Follow this simple strategy:

👉

Want more credit tips? Check out my Credit Playlist.

Your credit score plays a significant role in determining your mortgage options and interest rates. The higher your score, the more favorable your terms will be. If you’re serious about buying a home, take steps to monitor and improve your credit score with the tips above.

For personalized advice, reach out to a mortgage expert, and don’t forget to check out my other videos and blog posts for even more home-buying tips.

💬 Have questions? Reach out to me directly—I’m happy to help!

All Rights Reserved | Jennifer Hughes Hernandez | Senior Loan Officer | NMLS #514497

Full service residential lender with an experienced team offering expert service, reliable communications and on-time closings in the greater Houston area.

Every week we release educational videos related to hot topics in the mortgage industry on YouTube.

Subscribe to our channel to stay in-the-know!

Gardner Financial Services, Ltd., dba Legacy Mutual Mortgage, NMLS #278675, a subsidiary of Texas Partners Bank. 18402 U.S. Highway 281 N, Ste. 258, San Antonio, TX 78259. AZ BK-2001467. Check registration and licensing at nmlsconsumeraccess.org. Legacy Mutual Mortgage is an Equal Housing Lender. This is not a commitment to lend. Material is informational only and should not be construed as investment or mortgage advice. Legacy Mutual Mortgage is not an agency of the federal government. Not all loan products are available in all states. All loans are subject to credit and property approval. Not all applicants qualify. Restriction and conditions may apply. Information and programs current as of date of distribution but may change without notice. [11/2025]