We are an Equal Employment/Affirmative Action employer. We do not discriminate in hiring on the basis of sex, gender identity, sexual orientation, race, color, religious creed, national origin, physical or mental disability, protected Veteran status, or any other characteristic protected by federal, state, or local law.

What You Need to Know About Experian Boost and How It Affects Buying a Home

As you prepare for homeownership, understanding your credit score and how tools like Experian Boost may impact it can be essential for success. While Experian Boost can offer a quick way to potentially increase your score, lenders don’t always view it favorably in the mortgage process. Here’s a breakdown of what Experian Boost is, why it may not be ideal for home buyers, and how to set yourself up for mortgage approval.

What Is Experian Boost?

Experian Boost is a relatively new tool that allows consumers to add on-time payments for non-traditional items like rent, utilities, phone, and streaming services to their Experian credit report. Since these types of bills aren’t typically reported to the credit bureaus, Experian Boost can increase your score by incorporating timely payments from bills not usually factored into credit. For those trying to establish or improve their credit, adding these bills can help reflect a positive payment history and theoretically give a “boost” to your score.

How Experian Boost Is Viewed by Mortgage Lenders

While Experian Boost may seem like an easy way to enhance your credit report, most mortgage lenders view it differently. The added non-traditional payment data—such as utility and phone bills—do not reflect creditworthiness in the way that traditional credit items, like loans or credit cards, do. Lenders don’t allow a consideration of the Experian Boost because these additions artificially inflate your score without demonstrating long-term credit management.

As a result, many lenders may require you to remove these Experian Boost entries from your report to evaluate your “true” credit score. They want to see your credit history based on traditional items. So, while Experian Boost could improve your score in certain cases, when it comes to the home-buying process the lender will remove these added items.

Why Doesn’t It Count?

Understandably, it can feel frustrating that your diligent, on-time payments for rent and utilities aren’t seen as equally important in the mortgage process. These monthly payments represent responsibility and reliability, so it seems logical they would contribute to your credit score. However, traditional credit reporting and lending guidelines follow strict standards on what is included, focusing on items that directly relate to credit usage and long-term financial management, like credit cards, loans, and other revolving accounts.

Preparing for a Home Purchase: Key Steps to Take

If you're looking to purchase a home, it’s important to understand what lenders see in your credit history. Starting with a pre-approval process 6 to 12 months before buying is a wise step. This timeline gives you an opportunity to work with a lender to evaluate your credit profile, understand any adjustments you may need to make. Lenders are on your side…they want to help you get to the point of becoming a homeowner. By working with a lender early on, you’ll have the guidance and insights needed to make smart credit decisions and enhance your credit score in ways that mortgage lenders value.

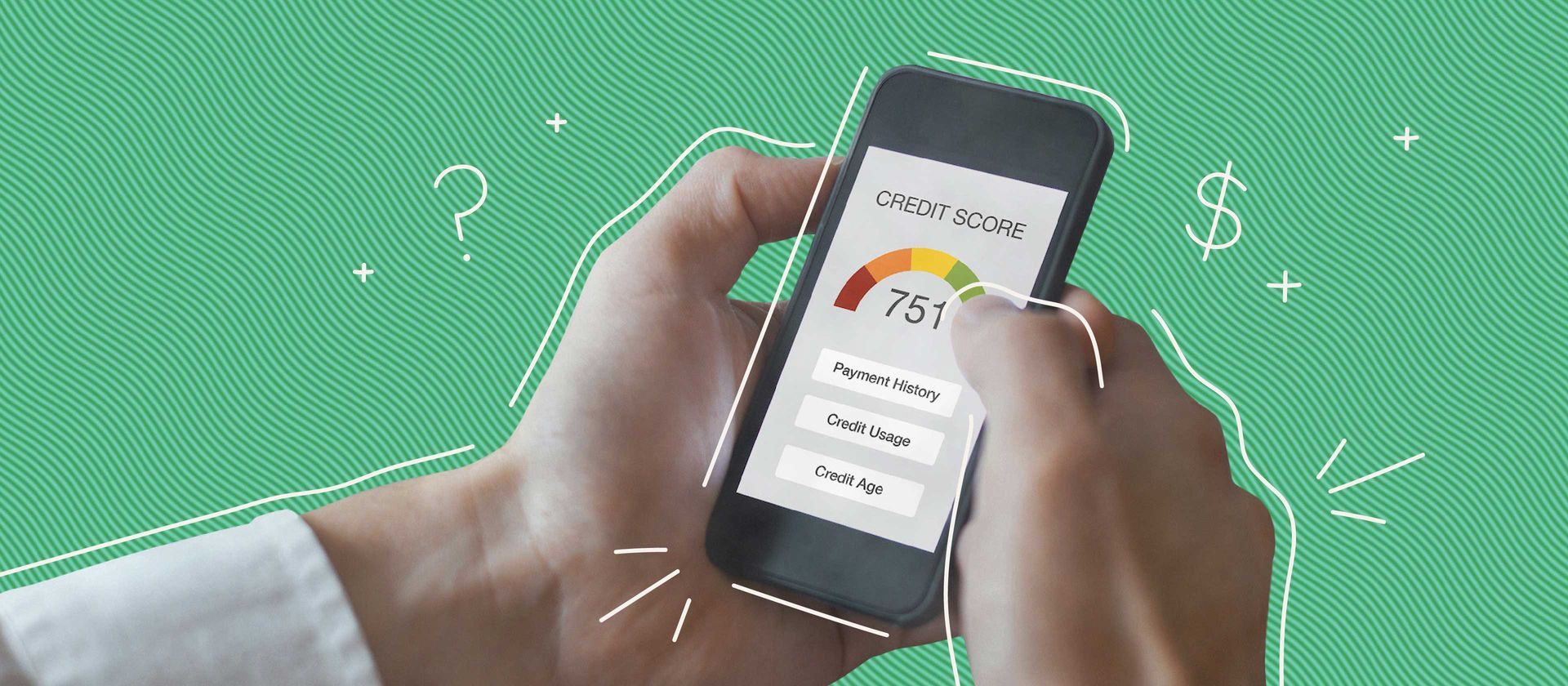

How to Improve Your Credit Without Experian Boost

If you’re advised against using Experian Boost by your lender, there are other ways to build and improve your credit score over time. Here are some tried-and-true methods:

- Pay Down Credit Card Balances: Reducing your balances on revolving credit accounts, such as credit cards, can significantly improve your credit score by lowering your credit utilization ratio to 1/3.

- Keep Oldest Accounts Open: While you may be tempted to close all accounts you don’t use, keeping your oldest accounts open can benefit your score, as it contributes to your credit history and overall utilization rate.

- Avoid Opening New Accounts Right Before Buying: Each new account can temporarily lower your credit score and make lenders wary. Try to hold off on any new credit activity at least six months before applying for a mortgage.

- Make Consistent, On-Time Payments: Late or missed payments have a big impact on your score, so make it a priority to keep all payments current. This is one of the biggest factors in building a solid credit history.

- Monitor Your Credit Regularly: Check your credit report for errors or any signs of identity theft, as correcting mistakes can give your score an instant boost. Regular credit report monitoring is essential for staying informed of any changes, especially when preparing to buy a home. By checking your report frequently, you can catch and address any inaccuracies that may impact your credit score. MyFICO offers easy access to your credit information, making it simple to stay on top of your financial health.

- Get Professional Advice: If you’re unsure where to start, credit counseling can be a great resource to create a tailored plan for improving your credit based on your unique financial situation. If you're interested in knowing more about credit score when applying for a loan feel free to read this blog “ The truth about credit when buying a home”

The Value of Pre-Approval

Pre-approval is one of the best ways to set yourself up for success when buying a home. A pre-approval allows a lender to review your financial history, including your income, credit score, and other key factors, to give you a clear picture of your borrowing capacity. Not only does pre-approval give you an accurate idea of what you can afford, but it also highlights any potential issues with your credit that you can work on beforehand. A trusted lender will give you tasks to help boost your credit so you can get the best interest rate available.

Starting this process early gives you the time needed to address any credit adjustments before you’re in the position of applying for a mortgage.

Is Experian Boost Worth It for You?

Experian Boost might seem like a way to increase your credit score, but if you’re planning to buy a home, you should think carefully before using it. Mortgage lenders view the Experian Boost as a manipulation of your credit score. Instead, working with a lender early in the home-buying process allows you to understand what’s needed for mortgage approval and helps you set realistic credit goals. Learn more about Experian Boost here.

If you’re serious about buying a home, check out my video, why it’s important to get pre-approved six months before buying a home. It offers valuable tips for maximizing your credit and financial profile to help make the home-buying process as smooth as possible.

By taking steps now, you’ll be well on your way to achieving your homeownership dreams, armed with the knowledge you need to make the best financial decisions. Get in touch with a mortgage expert to guide your home-buying journey.