We are an Equal Employment/Affirmative Action employer. We do not discriminate in hiring on the basis of sex, gender identity, sexual orientation, race, color, religious creed, national origin, physical or mental disability, protected Veteran status, or any other characteristic protected by federal, state, or local law.

The Ultimate Guide to Conventional Conforming Loans: 2025 Loan Limits, Pros, and Cons

Are you curious about how conventional conforming loans work and how they might apply to you? Each year, the Federal Housing Finance Agency (FHFA) reevaluates loan limits across the United States based on housing market trends. For 2025, these loan limits have increased again, making it easier for buyers to access affordable financing options with low down payments.

This post dives deep into the latest updates, the benefits and drawbacks of conventional loans, and tips for maximizing your mortgage potential.

What Are Conventional Conforming Loans?

You may hear the term Conventional Loan, or Conforming Loan or Conventional Conforming Loan. They are all the same. A conventional loan is a mortgage not backed by a government agency like FHA or VA loans. The term "conforming" refers to loans that adhere to the lending standards set by Fannie Mae and Freddie Mac, including loan size limits.

For 2025, the baseline conforming loan limit is $806,500, up from $762,000 in 2024. For high-cost areas, the maximum is $1,209,000, making homeownership more accessible in regions with soaring property values.

How Loan Limits Are Determined

The formula for determining loan limits is based on the Housing Price Index (HPI) calculated by the FHFA. Here's how it works:

- The HPI for the third quarter of the current year is compared to the same period the year before.

- The percentage increase in home values dictates how much loan limits rise.

In high-cost areas (think California, New York, and parts of Virginia), limits are adjusted to reflect regional property values. Areas like Hawaii, Alaska, and Key West, Florida, also fall into the high-cost category.

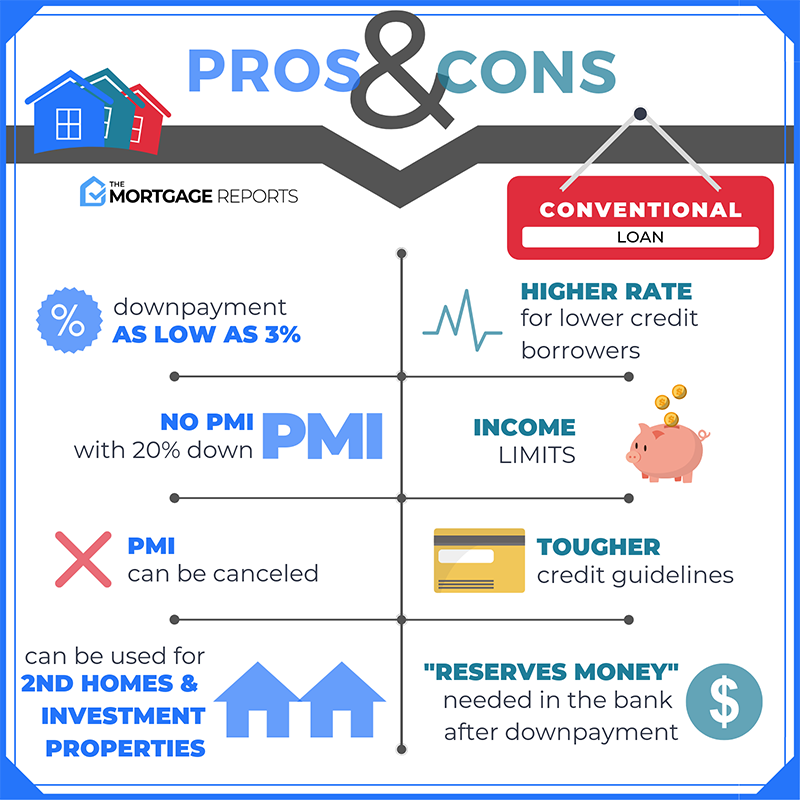

Pros of Conventional Conforming Loans

These loans come with several "superpowers" that make them a popular choice among buyers:

1. Low Down Payment Options

- First-time buyers can put down as little as 3%.

- Repeat buyers only need

5% down.

This makes conventional loans a great option for those without a large savings reserve.

2. Flexible Co-Borrower Rules

Conventional loans allow non-occupant co-borrowers, like parents or relatives, to help you qualify for a loan. This is especially helpful if you’re a first-time buyer with limited income.

3. Leniency for Self-Employed Borrowers

If you've been self-employed for more than five years, you may qualify with just one year of tax returns, simplifying the approval process.

4. Rental Income Flexibility

If you're moving out of your current home and plan to rent it, conventional loans allow you to count that rental income to offset your mortgage payment.

5. Multi-Unit Properties

With conventional loans, you can finance up to four-unit properties with just 5% down if you plan to occupy one of the units. This is a fantastic way to start building wealth through real estate.

Cons of Conventional Conforming Loans

While conventional loans offer plenty of advantages, there are some potential downsides:

1. Credit Score Sensitivity

- High credit scores (780+) unlock the best rates and lowest private mortgage insurance (PMI) costs.

- Scores below 720 can result in higher interest rates and PMI.

2. Strict Post-Bankruptcy and Foreclosure Waiting Periods

- Bankruptcy: A waiting period of 4–5 years, depending on the type.

- Foreclosure: A waiting period of 7 years before qualifying.

3. Limited Seller Credits

- For down payments below 10%, seller credits are capped at 3% of the purchase price.

- Larger down payments allow for increased seller credits: 6% for 10% down and 9% for 25% down.

Why Conventional Loans Are Still a Top Choice

Conventional loans remain popular for their versatility and competitive terms. Here are some key reasons they stand out:

- Customizable Rates and Terms: High credit scores result in lower interest rates and PMI.

- PMI Flexibility: Unlike FHA loans, PMI can be removed once you reach 80% loan-to-value (LTV).

- Broad Accessibility: Whether you're buying a single-family home, multi-unit property, or moving to a high-cost area, there's likely a conforming loan option for you.

Resources to Explore

To dive deeper into the details mentioned above, check out these resources:

- What Is Private Mortgage Insurance (PMI) and why chose it?

- Understanding FHA Loans and Their Benefits

- How to Boost Your Credit Score Quickly without Experian Boost

- Check the Latest Conforming Loan Limits in Your Area

- Self-Employed? Here's How to Qualify for a Mortgage

Final Thoughts

Conventional conforming loans are a powerful tool for homebuyers, offering flexibility, competitive rates, and options tailored to your financial situation. Whether you're a first-time buyer or a seasoned homeowner, conventional loans are a great option!

Looking for expert advice? Reach out to discuss your options and get pre-approved today.