We are an Equal Employment/Affirmative Action employer. We do not discriminate in hiring on the basis of sex, gender identity, sexual orientation, race, color, religious creed, national origin, physical or mental disability, protected Veteran status, or any other characteristic protected by federal, state, or local law.

The Four Types of PMI: Which One Will You Have?

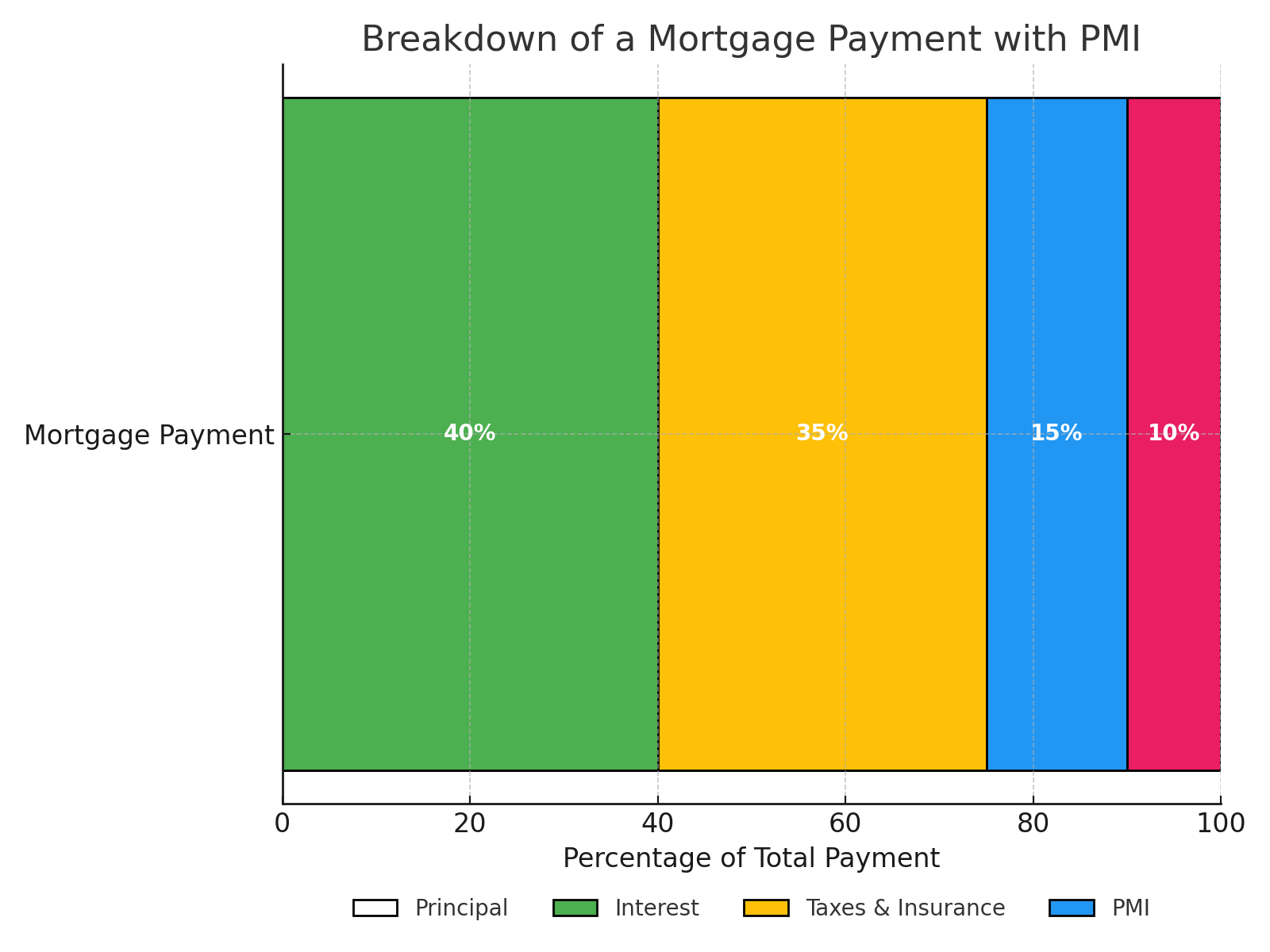

When it comes to buying a home with less than a 20% down payment, Private Mortgage Insurance (PMI) almost always becomes a part of your monthly payment. Did you know there are four types of PMI? Each option has unique features, so understanding these can help you make the best decision for your financial situation. In this guide, we'll break down the four types of PMI and share with you which ones fit your situation.

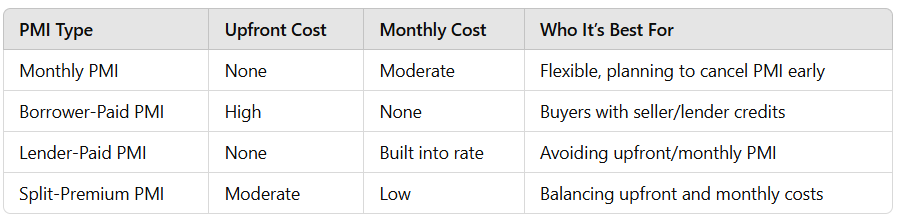

1. Monthly PMI: The Most Popular Choice

Monthly PMI is the most common option. Here’s how it works:

- Cost: Calculated as a percentage of the loan amount, divided by 12, and added to your monthly payment.

- Benefits: This is an excellent choice for borrowers planning to pay off PMI early by reaching 80% loan-to-value (LTV) through extra payments, bonuses, or selling another property.

- Why Choose It? If you’re looking for flexibility and don’t want a long-term PMI commitment, monthly PMI is a straightforward and popular choice.

2. Borrower-Paid PMI (Upfront PMI)

With borrower-paid PMI, you pay a one-time upfront fee instead of monthly payments.

- Cost: A single premium paid at closing. This fee can be:

- Covered by seller credits

- Paid by lender credits

- Paid out of pocket by the borrower

- Benefits: No monthly PMI reduces your overall mortgage payment.

- Why Choose It? Ideal for buyers who receive seller or lender credits or want to keep monthly payments lower.

3. Lender-Paid PMI

Lender-paid PMI eliminates the monthly PMI payment by slightly increasing your mortgage interest rate.

- Cost: An increased interest rate (usually 0.3% to 1% higher) depending on your credit score and down payment.

- Benefits: No out-of-pocket PMI payments or monthly add-ons.

- Why Choose It? It’s less common but may be an option if you want to avoid monthly PMI without paying an upfront fee. However, keep in mind the higher interest rate over the life of the loan, which does increase your monthly payment as well.

4. Split-Premium PMI

Split-premium PMI combines upfront and monthly PMI payments.

- Cost:

- A portion is paid upfront at closing (can be covered by seller or lender credits).

- The remainder is paid monthly.

- Benefits: Reduces your monthly PMI while requiring a smaller upfront payment than borrower-paid PMI.

- Why Choose It? This option is less popular due to its complexity but can work well for buyers looking to balance upfront and ongoing costs.

How to Choose the Best PMI for You

The right PMI option depends on your financial goals and situation:

- Are you looking to reduce monthly payments? Consider Borrower-Paid PMI or Split-Premium PMI.

- Want flexibility to cancel PMI early? Go with Monthly PMI.

- Prefer no upfront or monthly PMI payments? Explore Lender-Paid PMI.

Steps to Take:

- Work with a Local Lender: Your lender will guide you through PMI options and provide estimates tailored to your loan amount and credit score.

- Compare Costs: Ask for a detailed breakdown of each PMI option in a spreadsheet or chart to see how they affect your payment and overall loan cost.

- Get Pre-Approved: Pre-approval is essential to understanding your PMI costs and securing the best mortgage rate.

Understanding the four types of PMI can save you money and ensure your mortgage aligns with your financial plans. Start by talking to a trusted lender, at Legacy Mutual Mortgage, to learn about your PMI options.

Ready to explore your PMI options?

Helpful Resources:

- Pros and Cons of Lender-Paid PMI

- Understanding Interest Rate Increases

- How to Calculate PMI Costs

- Upfront PMI vs. Monthly PMI

- Learn More About Texas Home Loans

- Watch: what is PMI

Have questions about PMI or the home-buying process? Don’t hesitate to reach out—I’m here to help you find the best solutions for your unique needs. Whether you're just starting your journey or finalizing your plans, let’s work together to make your dream of homeownership a reality!