We are an Equal Employment/Affirmative Action employer. We do not discriminate in hiring on the basis of sex, gender identity, sexual orientation, race, color, religious creed, national origin, physical or mental disability, protected Veteran status, or any other characteristic protected by federal, state, or local law.

Shopping for Home Insurance. Essential Tips to Save Money and Protect Your Investment

Home insurance is a must-have for homeowners, but with rising premiums and countless options, finding the right coverage can feel like an overwhelming task. After facing a sudden 30% premium increase on my own policy last year, I took the time to shop around, gathered advice from friends, and ultimately saved an additional 15% by comparing quotes. The process took some work, but the payoff was significant. In this post, I’ll break down key strategies to help you make an informed decision, including expert insights from Kathy Leger of Leger Insurance in Texas. Whether you’re renewing, buying a new policy, or simply wanting to understand your options, these tips will guide you through the essentials of finding cost-effective, dependable home insurance.

Tip 1: Understand Admitted vs. Surplus Lines Carriers

One of the most critical aspects of choosing a home insurance policy is understanding the difference between admitted and surplus lines carriers. According to Kathy, this distinction is especially important in Texas:

- Admitted Carriers are approved by the Texas Department of Insurance. They are financially regulated, meaning they must meet specific financial stability requirements and get approval for their rates. These carriers also follow state protocols for protecting policyholders if financial difficulties arise.

- Surplus Lines Carriers lack these regulatory safeguards. While they may offer competitive rates or insure hard-to-cover properties, they aren’t bound by the same state regulations and can technically leave the state without responsibility to policyholders. In the worst-case scenario, this can mean canceled policies or unpaid claims.

How can you tell the difference? When reviewing a quote, look for additional taxes or fees near the premium amount. These indicate a surplus line carrier. Also, agents are typically required to explain that a carrier is surplus if they are presenting this option, so don’t hesitate to ask for clarification to avoid unexpected risks.

Tip 2: Determine the Right Deductible for Your Budget

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in for a claim. Kathy advises carefully choosing a deductible that fits within your budget. Opting for a higher deductible often results in a lower premium, but this also means you’ll need to cover a larger portion of the cost in the event of damage. For instance:

- Example: If your home’s replacement cost is $500,000 and you select a 2% deductible, you’ll be responsible for $10,000 before insurance covers the rest. This can be a manageable way to keep premiums down, but ensure you’re comfortable with the deductible amount you select.

While a higher deductible can reduce your monthly premium significantly, make sure it’s a choice you can handle financially in case you need to file a claim. Consider building an emergency fund to cover your deductible if you’re opting for a larger amount. This strategy allows you to benefit from lower monthly premiums without the risk of scrambling to cover repair costs.

I go more into detail about insurance deductibles in this Article.

Tip 3: Why to Avoid Self-Insuring, Even if You Own Your Home Outright

Some homeowners think self-insuring—skipping insurance altogether—is a cost-effective choice, particularly if they own their homes outright. However, Kathy strongly cautions against this approach. Even if your mortgage is paid off, insurance provides essential protection for your asset.

While going without insurance might save you money upfront, it could lead to significant financial hardship if disaster strikes. Kathy emphasizes that even if you’re willing to shoulder some financial risk by opting for a higher deductible, going without insurance entirely is rarely wise. The policy essentially acts as a safeguard, allowing you to recover from major damage or loss without draining your savings.

You can look into replacement cost vs. guaranteed replacement to provide yourself at least a little bit of protection.

Tip 4: Don’t Be Lured by the Cheapest Policy

It’s tempting to go for the lowest premium available, but Kathy stresses that “the cheapest isn’t always the best.” Low premiums can indicate potential issues like limited coverage, hidden fees, or poor claim payouts. Just as with any major purchase, focusing on value over price is essential when insuring your home.

Kathy compares choosing an insurance policy to selecting a contractor or buying a car. The cheapest option may cut corners, offer minimal service, or simply leave you in the lurch when you need help. She advises homeowners to remember that a quality policy is a promise—not just a piece of paper. If a carrier’s rates are surprisingly low, ask yourself, “What is being sacrificed to meet that price point?”

Tip 5: Ask Your Agent the Right Questions

When evaluating home insurance options, the questions you ask can significantly impact the quality of your policy. Kathy provides us key questions to ask your agent to ensure you’re getting the best coverage for your needs:

- What type of policy are you recommending, and why? This will help you understand your coverage options and why your agent suggests certain terms.

- What happens if I need to file a claim? Will the agent or their team help you with the claims process? This can save you a lot of time and stress in the long run.

- What happens if my renewal rate increases? There’s a big difference between agents who represent a single carrier/insurance company and independent agents who work with multiple insurance companies. An independent agent has more flexibility to find a better rate if your current policy becomes too expensive at renewal. If you’re working with an agent who can only offer one company’s policies, your options for renegotiating a better renewal rate may be limited.

- How long has the carrier been operating in my state? It’s important to know that your carrier is stable and committed to serving your area. Even well-established companies can enter and exit specific states, so ensuring they’re committed to your area is important.

- What is the claims satisfaction rate? Independent agents can often provide important information into a carrier’s reliability when it comes to claims. Some companies are notorious for delaying or denying claims, so asking your agent for a candid perspective on the carriers they work with can save you headaches down the line.

The Value of Working with an Independent Agent

One of the most valuable pieces of advice from Kathy is to work with an independent insurance agent. Independent agents are not tied to a single insurance company, so they can shop around on your behalf, offering multiple options that suit your budget and coverage needs. Their commitment is to you, not a particular carrier, which provides the advantage of flexibility, particularly if your renewal rate rises. Independent agents also bring experience from working with various insurers and are well-positioned to advise you on which companies are known for reliable claims processing. Save yourself time and money, and let an independent insurance agent find the best policy for you.

Learn more about the different types of Insurance agents.

Protect Your Investment with Smart Choices

Whether you are a collector, or have personal items that are irreplaceable, your home holds valuables that make it your home. Home insurance is a fundamental part of homeownership, protecting not only the structure of your house but also all the items within your house that make it your home. By understanding the different types of carriers, choosing a deductible that fits your budget, and working with an independent agent, you can find a policy that offers both peace of mind and financial security. Instead of automatically choosing the lowest premium, remember that your home deserves high-quality protection.

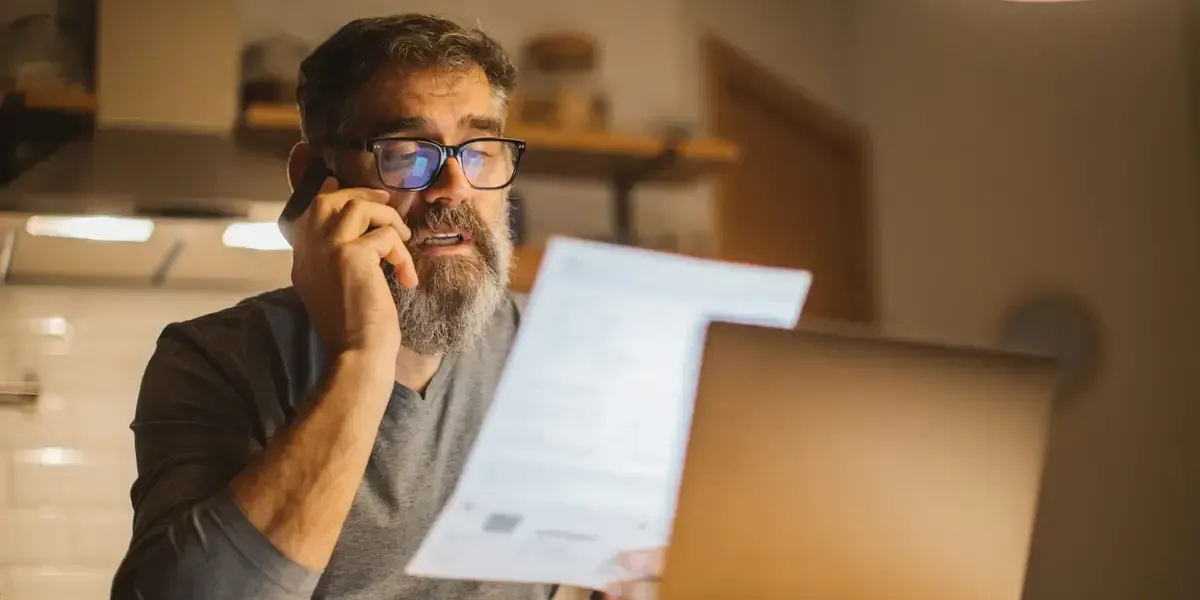

Communicate with Your Lender

Lastly, inform your mortgage company of your new insurance company and policy. They will be informed when you cancel your policy, but not necessarily informed by the new insurance company that you have a new policy. The last thing you want to happen is for your mortgage company to put their own insurance policy on your house because they are unaware that you purchased a new coverage. If this happens, your mortgage payment will go up to cover the cost of the insurance plan your mortgage company purchased. Avoid this mistake and send your mortgage company a copy of your declarations page to show you have new home insurance.