We are an Equal Employment/Affirmative Action employer. We do not discriminate in hiring on the basis of sex, gender identity, sexual orientation, race, color, religious creed, national origin, physical or mental disability, protected Veteran status, or any other characteristic protected by federal, state, or local law.

How are Mortgage Rates Determined: Your Guide

Whether you're a first-time homebuyer or you're onto your second or third home, you have had an experience with, or heard about mortgage rates.

Buying a home for most people involves borrowing large sums of money from a lender, so it's helpful to know exactly what affects these rates. While there are a variety of factors that can affect mortgage rates, there are some that are beyond your control. However, by controlling the factors that are in your control, you will have more choices when it comes to making your next home purchase.

Have you ever wondered how are mortgage rates determined? Then you may want to keep reading! This article breaks down the different factors that affect mortgage rates, including factors like the economy, stock market, your down payment, and your credit score. No matter what your situation, this information can guide you to understand rates and how they move, so you can be empowered to make the best financial decisions when the time is right.

What is a Mortgage?

A mortgage is essentially a documented agreement between you and a lender that grants the lender the right to revoke your property should you fail to repay the money you've borrowed.

The mortgage amount also has interest attached, which you are also expected to repay for the duration of the loan. A mortgage rate is what it costs to borrow money from that lender. That financial institution, aka lender, determines what the rate will be, and in addition, rates can vary from lender to lender. Rates can be fixed or variable. Fixed means that the interest is fixed for the duration of the loan and never changes. Variable loans are called ARMS, which stands for Adjustable Rate Mortgages. ARMS are usually fixed for a period of time, and then adjust with frequency for the remainder of the loan.

This is one reason to work with a trusted, reputable source. To be sure you are obtaining the most accurate information and education about your best choices during the process.

How Are Mortgage Rates Determined

To help give an overview of the various factors that affect mortgage rates, the factors listed below were broken down into two categories: market factors and personal factors. Market factors are factors outside of your control, while personal factors are things you can control.

Market Factors

The Federal Funds Rate

The federal funds rate is defined as the interest rate at which banks charge each other to borrower or lend excess reserves overnight. The U.S. Federal Reserve , better known as the Fed, meet a minimum of 8 times per year to potentially lower, raise or maintain the federal funds rate. They change this federal funds rate in order to affect supply and demand, and in turn the economy. This is NOT to be confused with the mortgage rates. They are not identical. However, there is some influence. In order to control inflation, the Fed will increase the federal funds rate. The theory is that with higher rates, people will not spend as much money, and in turn prices of goods will come down. That is because when goods are not in demand, companies will lower their prices to attract buyers. On the other hand, when monetary policy is lowering the federal funds rate, it is usually when inflation is under control, or decreasing. This can reflect in mortgage rates going down. The increase and decrease is not an exact science, but the historic trends are what we can now review in order to suspect what rates will be doing.

Economic Health

When it comes to the economy, many factors affect its overall health, and therefore the rates from everything to credit cards, car loans, mortgage loans etc. When the economy appears more bleak, mortgage rates typically fall. In other words, if unemployment is high, and growth is slow, expect lower mortgage rates. When times are good, and the outlook of the economy is bright, people are employed, and the demand for goods is high. There is more money being spent. When demand is high, rates tend to increase.

Wall Street

Believe it or not, on a daily basis Wall Street, or better said the stock market, has A LOT to do with the fluctuation of daily rates. Mortgage notes are pooled together to form a mortgage backed security, or MBS. One MBS could contain thousands of mortgage notes, and has an average coupon rate of xyz. This coupon rate is the guaranteed payback to the investor(s). That is why they are popular.

An MBS does not have the volatility that the stock market does. That being said, as confidence in the stock market is down , meaning investors are fearful of volatility in the riskiness of stocks, they will put more of their money in the safe haven of bonds, which is where the MBS are allocated. This fear in the stock market is caused by any number of things. Bad news on about a foreign country, or our economy, or release of companies earnings. Whatever the case, when more money is going into the bond market, where the mortgage backed securities are, the demand for those MBS notes is high, so the price goes up, and the yield, or rate, goes down. More people buying bonds, makes the rates go down.

On the reverse, when more investors on Wall Street are buying stocks, because they feel good about the economy, the bond market suffers, and the rates go up, to attract more buyers back. The actual workings of the bond and stock market are more complex, but I hope this simplified explanation gives you the basic idea.

It's volatile out there, and changing on an hourly basis when the stock market is open for business.

Personal Factors

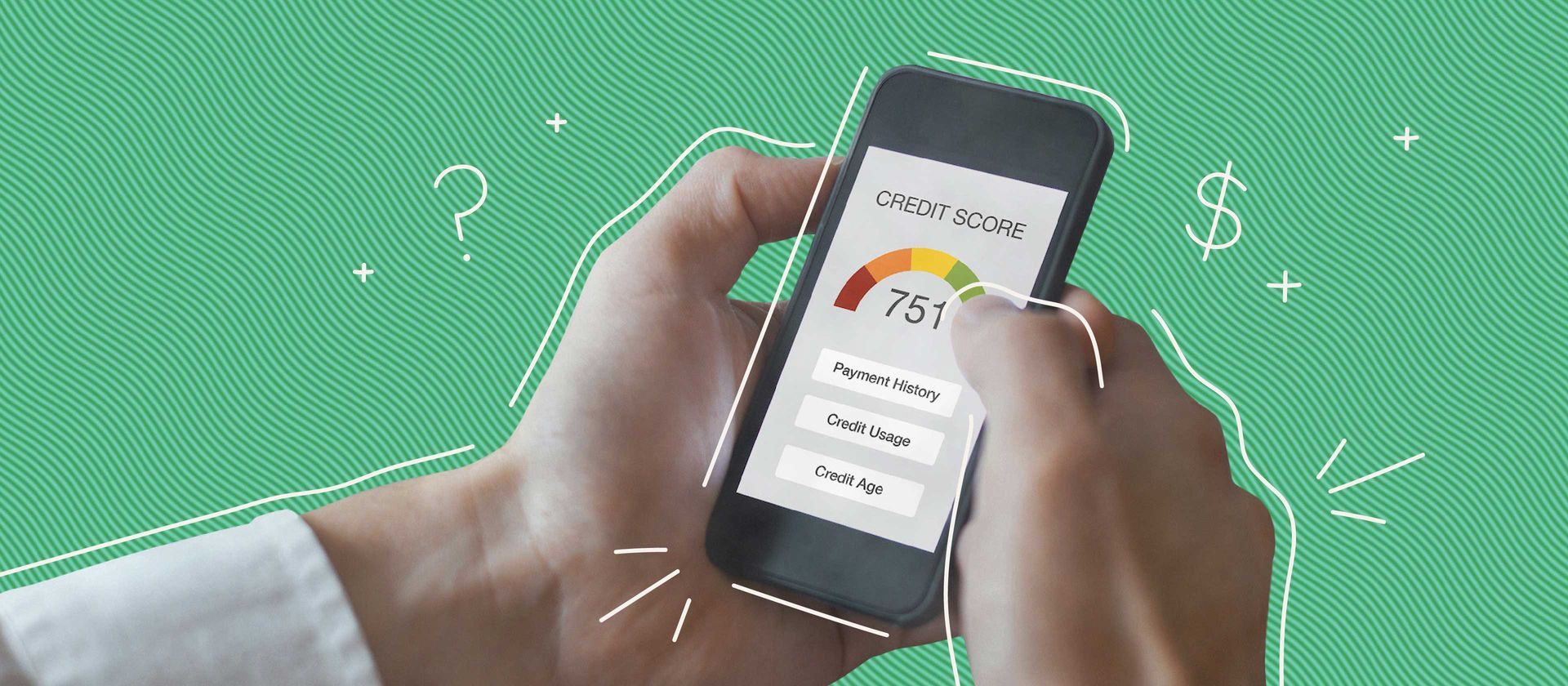

Credit Score

To put it plainly, your credit score is the #1 factor that determines how likely you are to pay your mortgage on time. Therefore, as your score is higher or lower, the rate for which you are offered could be different. In general, borrowers with scores 760 to 850 are the most rewarded with lower rates. Lower credit scores, in the 600's, in many cases, depending on the loan product, are higher, due to the borrowers risk profile of historic credit payments.

My recommendation is to talk to a lender about pre approval six to nine months BEFORE buying a home, so that if you have homework to do with your credit, there is time to do it!

Down Payment

Another personal factor that affects your mortgage rate is your down payment or the amount you're able to immediately invest in your home. Generally, interest rates are slightly lower with 20 percent down. Know that there are lower down payment loans available! As little as 3 percent for first time buyers. However there might be a slight price tag in the form of a higher rate.

That is because the risk for the lender is higher with less down payment. In the event the borrower forecloses, there is not much equity to allow the lender to sell quickly at a discounted price if needed.

Occupancy

For mortgage lenders, there are only 3 types of occupancy. Primary, Secondary, or Investment. Owners that will occupy as their primary residence, are favored, and therefore lower rates will apply. This is because the historical data suggests that owners that occupy in this manner , will take their mortgage more seriously in the event of financial decline. It is where their family resides! Lenders find that owners take that more seriously to pay on time.

On the contrary, a secondary residence, which is a vacation home, or an investment property, has statistically shown that in hard times, these are the properties that borrowers will let go first, because they want to protect where they are living with their families.

Use a Trusted Lender Today!

As you can see, there are many factors that go into determining the interest rates. A trusted lender can be hard to find, with so many choices out there. My recommendation is to be sure that in your research , you consider a local lender that is referred, and that is also local to your city or even state.

If you're ready to buy your home in Texas or are interested in Texas real estate, contact Loan with Jen today. Here, you'll find a trusted, reliable lender that can guide you through the process of financing a home.