We are an Equal Employment/Affirmative Action employer. We do not discriminate in hiring on the basis of sex, gender identity, sexual orientation, race, color, religious creed, national origin, physical or mental disability, protected Veteran status, or any other characteristic protected by federal, state, or local law.

Home Buying: Basic Pre Approval Requirements

Are you wondering the basic requirements of buying a home? One thing is for sure, and that is CHANGE. The real estate industry is no stranger to change, and this article will help you know the basics, so that you are able to make your home buying plans a reality, regardless of what industry regulations and changes are thrown our way.

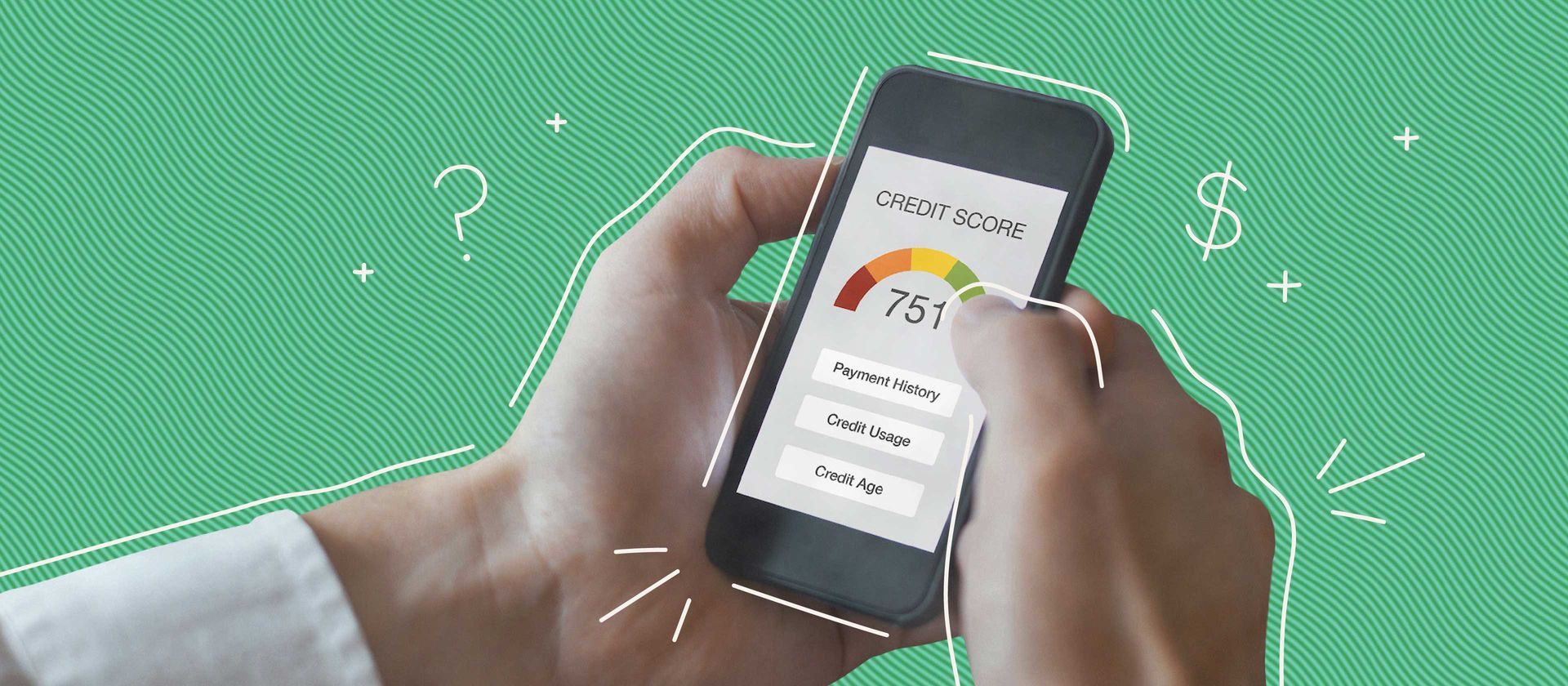

Credit Will Always be Your Gateway to Homeownership

Think of your credit score as the key that unlocks the door to your future home. It's more than just a number; it's a snapshot of your financial story that lenders use to decide if you're ready for a mortgage. But here's the thing: no one expects perfection. In the real world, credit scores vary, and thankfully, there are different types of loans tailored to meet these variations.

Maintaining and improving your credit is the key, so that when it is your time to buy, you have the best options available to you at that time. MyFICO.com provides the most accurate score that consumers can see that is closest to what lenders pull.

Pre Approval is Key

This process is likely the most misunderstood . You will hear terms like pre-qualification and pre-approval. It’s very easy to confuse the two . A pre-qualification is basically an application plus a credit review. This does offer valuable insights, however , it lacks the most crucial part of the mortgage process, which is documentation.

With verification of income, assets and credit properly documented and reviewed, the lender is able to provide a letter of pre approval, which will be required to make an offer to a seller. The sellers will want the assurance that your entire background has been vetted thoroughly.

Our suggestion is to consider

pre approval 6-12 months from the time you plan to purchase. This will give you crucial insights to your maximum buying power, as well as any credit fixes you can attain to achieve a higher score for the future event of home buying! This will ensure you have many choices at hand in your financing instead of a select few.

Documentation to Provide

At the pre approval stage, you should be expecting to provide documents that confirm your income and savings. You can download a list of documents required HERE.

You should expect that these documents are required at the beginning of your process with a lender. If a lender does not require these items, it actually can be a sign of a red flag in the accuracy and efficiency they are willing to provide. Can you get advice and basic information without documentation? Sure you can, however this will set you up for possible surprises later on.

The basic rule to remember is 2-2-2. This means providing 2 recent paystubs, 2 years W 2 forms, and 2 months bank statements. If you are self-employed, meaning that you own more than 25% of a company, then you will need to provide tax returns for 2 years as well in most cases. Also be prepared to verify your legal identity and ability to work in the US. This is with a US passport, resident card, or work permit.

There are other forms and documents that might be required in your situation, for things like retirement income, social security, child support etc. You can find a complete list here of documents that could be required.

Basic Income Requirements

The magic number for lenders is 2. Industry guidelines all agree across all of the programs , that 2 years is a stable overview of income, to know about the employability of someone. The fact of having a 2 year history of being employed, shows that you have stability, and if found unemployed, will have an easier time finding new employment. Good news! The 2 year history does NOT have to be all with the same employer. However, if you have changed jobs more than 3 times in a 12 month period, this could be questioned and need to be explained to establish stability.

An exception to the 2 year work history rule for employees, is attending university or some other type of training for your trade or industry. You would merely need to prove with a transcript or diploma that you were in school, and the requirement to have 2 years history of work is usually waived.

It is important to know that for employees, the gross income is used , not the take home income, when being reviewed by an underwriter. If relying on any additional income than your basic wage to qualify, like overtime, commission or bonus, the 2 years history of this income will come into play again. For this reason you should check with a lender immediately so proper calculation of income is attained.

If you are self employed, a 2 year period is also deemed enough time by underwriters to show how you manage expenses and have the ability to generate income. Your 2 year tax returns will show this, and the underwriters will look at the net income, after expenses have been deducted.

It’s worth mentioning secondary income. There are many people that rely on a second job to make ends meet. Especially in this case, a 2 year history of secondary employment is required. In addition, to prove that you have been able to carry 2 jobs for two years or more.

More the reason to check with a lender as soon as possible to make sure you know what income can count toward mortgage approval.

How Much House Can You Afford

Lenders will calculate your housing payment to be a cumulation of principal, interest, and a proration for property tax, home insurance and required HOA dues. This total payment in most guidelines should be no more than 40-43% of your total gross income that was calculated using the methods in the prior section. The reason we say ‘in general’ is because there are exceptions when a larger down payment is being made, like 20% or higher. In these cases, debt ratios could be considered up to almost 50% of your monthly gross income.

The maximum debt to income percentage, also known as DTI or Debt to Income, is 50% for Conventional Mortgages, and 55% for VA and FHA Mortgages. These mortgage types are some of the most common, and

represent a large percentage of loans (almost 80%) , especially for

first time buyers.

If you are looking for a general rule of thumb, you could take your annual household income from acceptable sources, and multiply by 3-4 times. That would give you an approximate home price. For example, if your income is $80,000 , multiplying it by 3 or 4 times, means a home price of $240,000 to $320,000. However, be careful with this formula, as it does not take into account how you got to the $80,000 in income, and whether the lender will calculate your income the same, especially if from overtime, commissions, or even a second job. Also, your debts overall must be considered from things like car payments , loans and credit cards. If your debt is more than 8-10% of your income, then the formula for the above calculation is not correct.

Down payment - the missing link

One of the biggest myths about home buying is that you have to put down 20% on a purchase. This is not the case. There are 3-5% down options available, depending if you are a first time buyer, or the loan program you are seeking, such as FHA , Conventional, or VA. These are some of the most common loan types in the industry.

Down Payment Assistance is surely available in each state, which can alleviate the need for funds required at closing. However, many of the down payment assistance programs have income ceilings, minimum credit score requirements , and maximum purchase prices or even areas of town a person can buy.

At the pre approval, the lender will determine the loan program you are qualified for, and what amount is required to close with not only down payment, but

closing costs. This final amount must be verified in your banking or investment accounts, or verified as a

gift from a close relation. All monies used for closing must be verified from an acceptable source. This is defined as money you have had on deposit for 60 days, or, deposits from your own earnings, or assets that you have sold that can be documented.

Cash money, aka mattress money, is not acceptable, because it cannot be sourced.

Bitcoin is mentioned a lot now, and becoming a looming question for funds. Bitcoin is allowed, however, the statements to prove bitcoin and its source in a 60 day period comes into question. Talk to a lender asap if this applies to you, as the rules for different programs vary greatly in this area.

In summary, be prepared to provide 2 months statements in checking, savings, investments, and retirement accounts. These must be full statements, all pages. Snapshots online are generally not accepted.

The Overall Picture

Remember, when lenders peek into your overall financial history, they're not just looking for numbers. They're trying to assess how well you handle financial responsibilities and changes. If you start the process prepared and ready to provide this information discussed above, you will have a smooth and accurate assessment to make your home buying journey a reality!

We would love to help you get started! You can

reach us here, and my team and I look forward to starting your home buying journey.