We are an Equal Employment/Affirmative Action employer. We do not discriminate in hiring on the basis of sex, gender identity, sexual orientation, race, color, religious creed, national origin, physical or mental disability, protected Veteran status, or any other characteristic protected by federal, state, or local law.

Understanding Conventional Loans: Your Guide to Smart Home Buying

Buying a home is one of the most significant investments you'll make in your lifetime, and understanding your loan options is crucial to making informed decisions. Today, we’re diving into the world of conventional loans, a popular choice for many homebuyers. Let’s break it down!

What Are Conventional Loans?

Conventional loans are mortgages that are not backed by the federal government, unlike FHA loans which offer government guarantees. This distinction is essential because conventional loans account for nearly 50% of the total mortgage market, making them a prevalent and viable option for homebuyers.

In this article you will find:

- An overview of conventional loans and their prevalence in the mortgage market.

- The role of the Federal Housing Finance Agency (FHFA) and its importance in regulating conventional loans.

- An explanation of Fannie Mae and Freddie Mac and their impact on mortgage accessibility.

- Information on down payment options, including 3% for first-time buyers and 5% for repeat buyers.

- Insights into loan limits based on geographical location and how to find relevant information.

- A breakdown of credit score requirements, including the implications of down payments on your score.

- Discussion of the debt-to-income ratio and its significance in the loan approval process.

- An explanation of Private Mortgage Insurance (PMI) and its necessity for lower down payments.

- Guidance on utilizing co-signers and down payment assistance programs to improve loan eligibility.

A Little Background on Conventional Loans

To understand conventional loans, it’s helpful to know where they come from. The Federal Housing Finance Agency (FHFA), created in 2008 after the mortgage crisis, acts as the watchdog of conventional loans, ensuring regulatory compliance and protecting consumers. It works closely with other agencies like the Consumer Finance Protection Bureau (CFPB).

When researching conventional loans, you’ll often come across two key names: Fannie Mae and Freddie Mac. These institutions are quasi-government entities that work with the government to offer mortgage credit to a wide range of borrowers, ensuring that homeownership is within reach for everyone.

Why Conventional Loans Are a Great Option

One of the biggest advantages of conventional loans is the flexibility in down payments. Did you know that first-time homebuyers can put down as little as 3%? That’s right! While many people think you need a 20% down payment, this isn't true for conventional loans. Even second-time buyers can put down just 5%.

The 20% down payment myth comes into play when it comes to Private Mortgage Insurance (PMI), which is required for loans with less than 20% down. But more on that later!

Conventional loans also have higher loan limits than FHA loans, making them ideal if you’re buying in a high-cost area. Each year, loan limits adjust based on the housing market, so it’s important to check the current limits in your area.

Credit Score Requirements for Conventional Loans

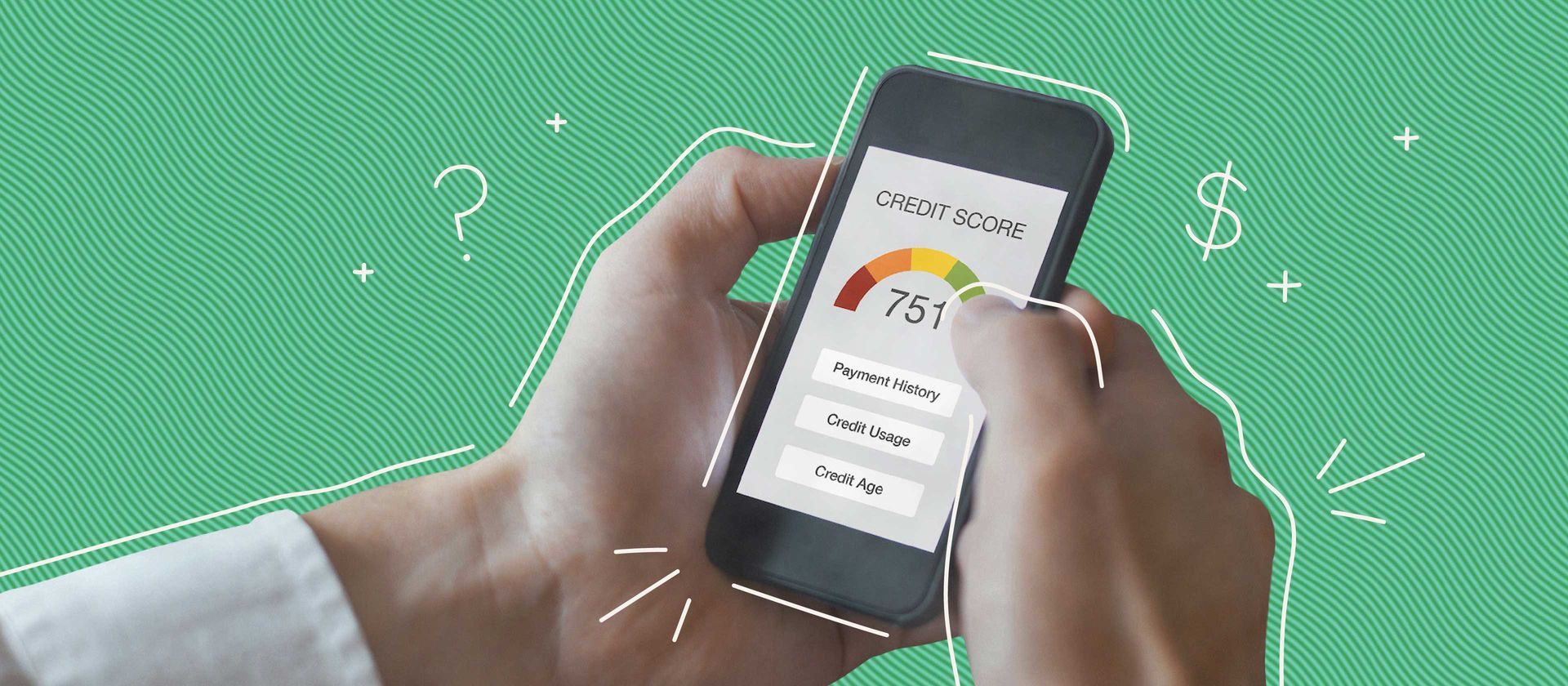

Your credit score plays a significant role in securing a conventional loan. Here’s a general guide:

- With a 20% down payment, you can qualify with a credit score as low as 620.

- If you put down less than 20%, the minimum score is 660, though aiming for a 700+ score will get you better interest rates.

The higher your credit score, the lower your interest rate and PMI will be. If you're considering a conventional loan, it’s a good idea to work on boosting your credit score to get the most favorable terms.

Debt-to-Income Ratio (DTI)

Lenders also consider your debt-to-income ratio (DTI) when deciding whether to approve your loan. Typically, lenders prefer your DTI to be below 45%, meaning that no more than 45% of your monthly income should go toward housing payments and other debts. However, with a larger down payment or strong credit history, some lenders may approve DTIs up to 50%.

Understanding Private Mortgage Insurance (PMI)

PMI is an insurance policy that protects lenders in case you default on your loan. It’s required for borrowers who put down less than 20% as a down payment. While PMI may seem like an extra cost, it actually makes homeownership possible for many buyers who don’t have a large down payment.

The good news? With some loans you don’t have to pay PMI forever. Once you reach 20% equity in your home, you can cancel PMI, lowering your monthly mortgage payment.

Other Considerations: Co-signers, Gifts, and Down Payment Assistance

Conventional loans offer flexibility in how you structure your mortgage. For example, you can have a co-signer, such as a family member or friend, to help you qualify for the loan. Additionally, conventional loans allow you to receive gift money for your down payment, making it easier to afford a home.

If you qualify, down payment assistance programs may also be available, helping you cover your initial costs and making homeownership more accessible.

Is a Conventional Loan Right for You?

Conventional loans are typically best for borrowers with higher credit scores, lower debt, and a stable income. If that sounds like you, getting pre-approved for a conventional loan will give you a clearer picture of how much house you can afford and what your monthly payments will be.

If you’re concerned about qualifying for a conventional loan, consider having a co-signer. This close family member or friend can help improve your loan application. Additionally, many states offer down payment assistance programs for eligible borrowers, so talking to your lender about these options can provide much-needed support.

For mortgage information on your residential real estate purchase , one to four family, contact us today at www.loanwithjen.com/contact